xHamster Data for Creators: Breaking Down the “Fan” Audience

In June, xHamster surveyed over 30,000 visitors to our site as to who they were, what they watch, and what they buy. Our goal is to better understand who is buying independent creator content — and to help you, our xHamster Creators, better reach that audience.

Who spends the most money?

- What types of content are most popular on fan sites?

- How are cam fans different from clip fans?

- Are my fans more likely to be single or married?

- How do new fans find us?

- What drives renewals?

Our survey is an unprecedented look into the demographics and behaviors of your fans, available only to xHamster Creators. This isn’t just about traffic or sales — we asked about everything from age, gender, and sexuality to education, income, and relationship status. We asked what types of content they liked, and how much money they spent on it.

Of the 30,000 people we surveyed:

- 17.3% have spent money on a cam site in the past year

- 18.3% have spent money on clips

- 19.5% have spent money on a studio or other paysite

- 26.8% have spent money on a fan site

That’s one reason the creator economy is booming. Over the next weeks and months, we’ll analyze the data to help you understand who your customers are, and how to better reach them. In our first installment, we look at the demographic profile of the paying audience — and how it differs, sometimes dramatically, from an audience that won’t pay.

What does the paying audience look like?

The data below applies to active consumers — defined as anyone who has spent more $5 or more on adult content in the past month. Even on a site where there’s nearly limitless free content, more than a third (34%) of visitors to xHamster said they’d spent money on adult content in the past month.

Identifying the difference between a fan who won’t pay, and one who will, is crucial to a successful business.

Gender

About a third of visitors to xHamster are women, but conventional wisdom says that they don’t purchase as frequently. At first glance, this appears to be the case. But the actual data is more complex.

Women may make up a third of the porn audience, but their behavior on site is different. (They don’t, for instance, share as much information on surveys.) Men may be the largest overall audience (making up over 85% of survey respondents) but when it comes to spending money, women are actually more likely to spend — especially at the higher levels. Here’s what the gender breakdown looks like if we only focus on people who spend over $100 a month.

Women and trans/non-binary people are more likely to be big spenders, while men are more likely to want free content. Much of this increase is driven by younger people, who are more likely to be gender and racially diverse. One possible reason? While straight cis men have a lot of free content to choose from, options are more limited for women and the gender non-conforming.

Or maybe they just are more likely to value the work of Creators.

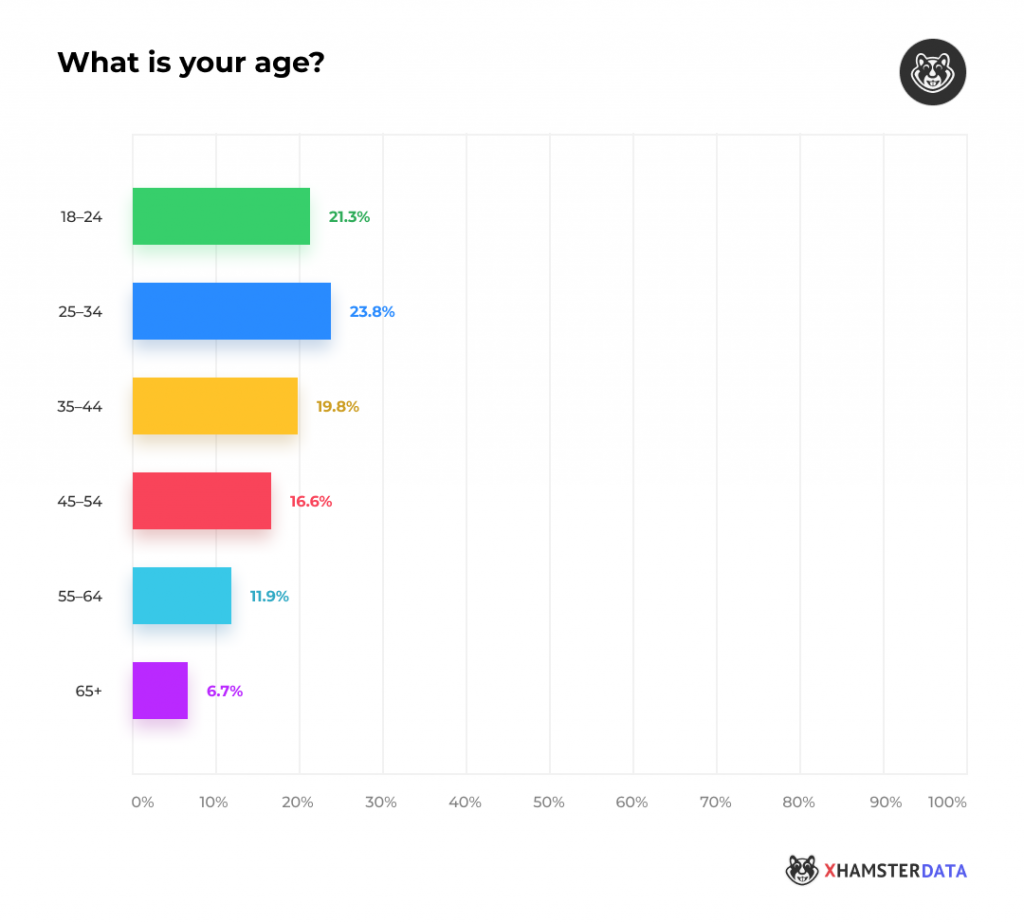

Age

Conventional wisdom suggests that young adults don’t spend much money on adult content because they’re less likely to have disposable income. But that turns out to not always be true. Those aged 18-24 make up just 28% of the overall audience, and 21% of active consumers — people who are buying content.

The biggest overall spenders are younger millennials — those aged 25-34. Nearly half of all sales are made by those who are under 34, and 65% of all sales are made by those under 44!

For years, the adult industry has assumed that older consumers, particularly men, were driving sales. That’s not the case anymore if it ever was.

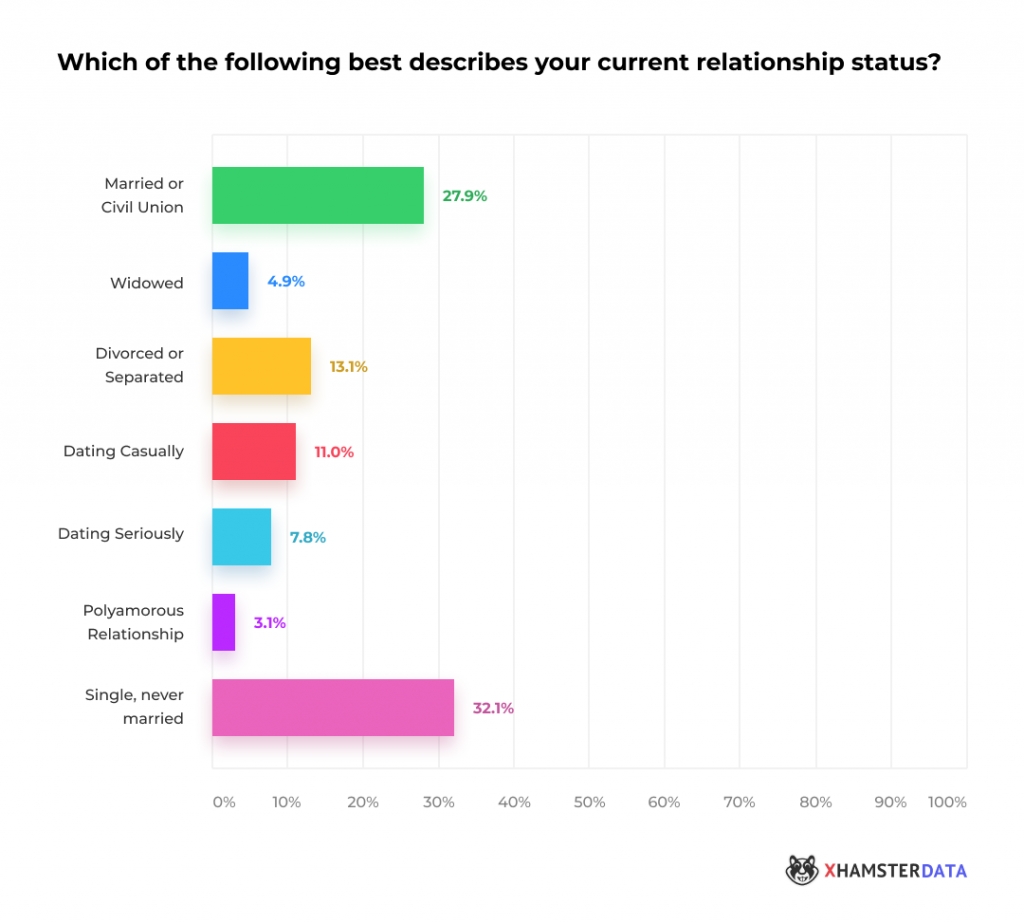

Relationships

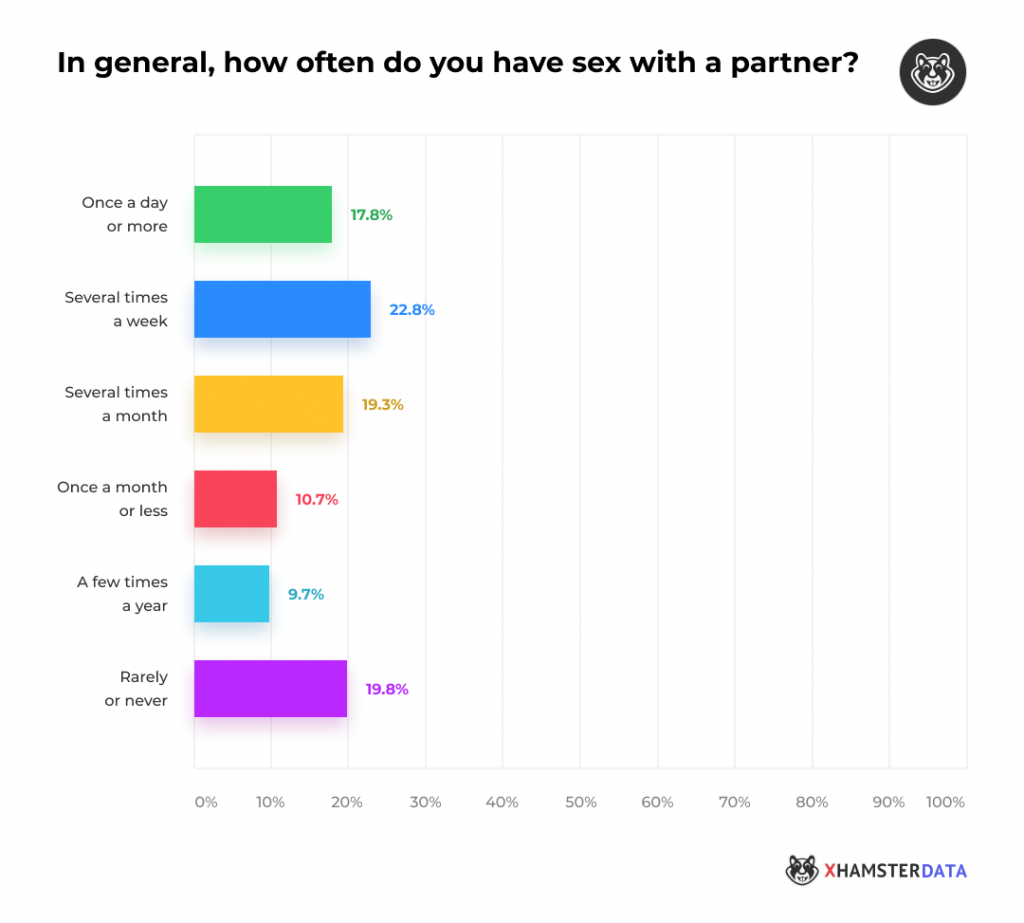

The media paints adult fans as lonely people who don’t have access to other outlets, but that couldn’t be further from the truth. While 45% of respondents were not currently in a relationship, that didn’t mean they weren’t sexually active. One in four people who reported being single (or divorced/widowed) also reported having sex with a partner several times a week or more.

In fact, those who spend money on adult content often have highly active sex lives. Nearly 60% of active consumers of those who purchase porn have reasonably active sex lives, and 40% report that they’re having sex several times a week or more. Again, this is a trend that intensifies at the higher spending levels.

People who have a lot of sex are more likely to spend money on porn. They value good sex, and invest in it! Those who aren’t getting laid are the ones most likely to expect it to be free. (Gee, I wonder why they’re not getting laid?)

The lesson? Don’t treat your fans like you’re their only option. It’s not that they can’t get sex, it’s that they can’t get enough of it.

Finding Fans

Now, the bigger question: how to find these fans.

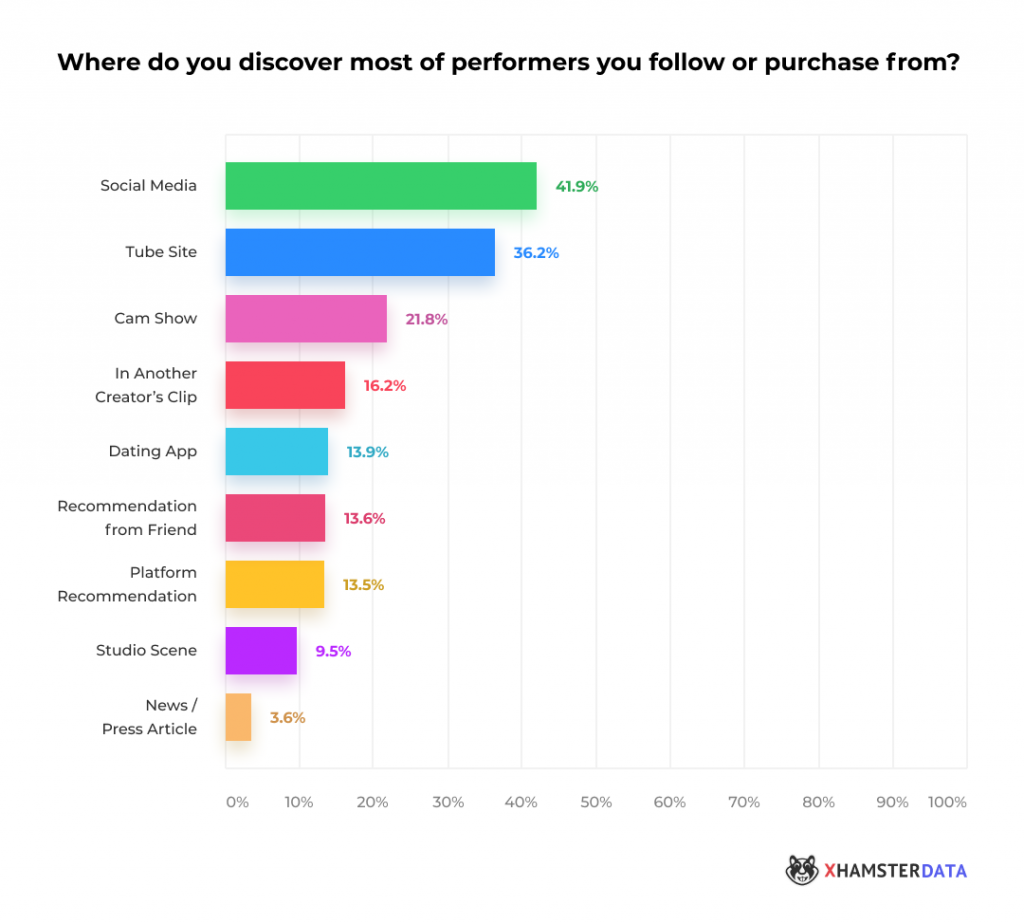

Not surprisingly, more than 40% of people who have bought Creator content cite social media as their biggest source of new accounts to follow or subscribe to. But tube sites are almost as important — and, more importantly, won’t ban your account for selling porn. (This is one of the reasons we started the xHamster Creator project, which creates a free, direct path from tube views to your “fan” site profile. Find out more here.)

Another surprising source? Cam shows. If you’re looking for new paying fans and not just followers, it makes sense to diversify. Twitter and Reddit are great, but adult sites make up the lion’s share of traffic for new subscribers.

Now that you’ve found them — and know they don’t mind getting out a credit card — how do you convert them? While many creators struggle with constant daily updates, our survey shows that quality can be more important than quantity.

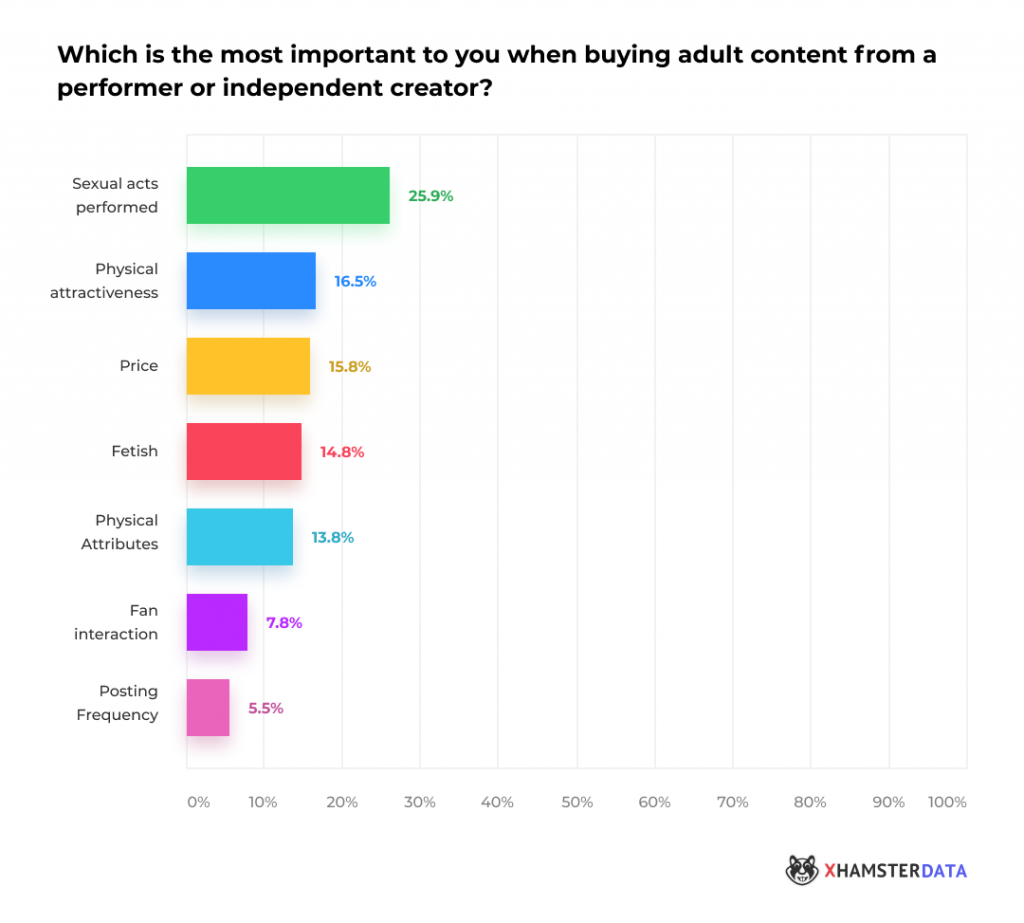

The most important thing to most active, paying consumers is the actual type of sex — in other words, what you do on camera. Physical attractiveness and price are factors, but not nearly as much as the quality of the content. The least important aspects to consumers looking to purchase? Fan interaction and the frequency of posting. This means that you shouldn’t worry as much about creating content every day. Instead, concentrate on creating quality content.

Give yourself a break, and focus on doing what you do, and doing it well.

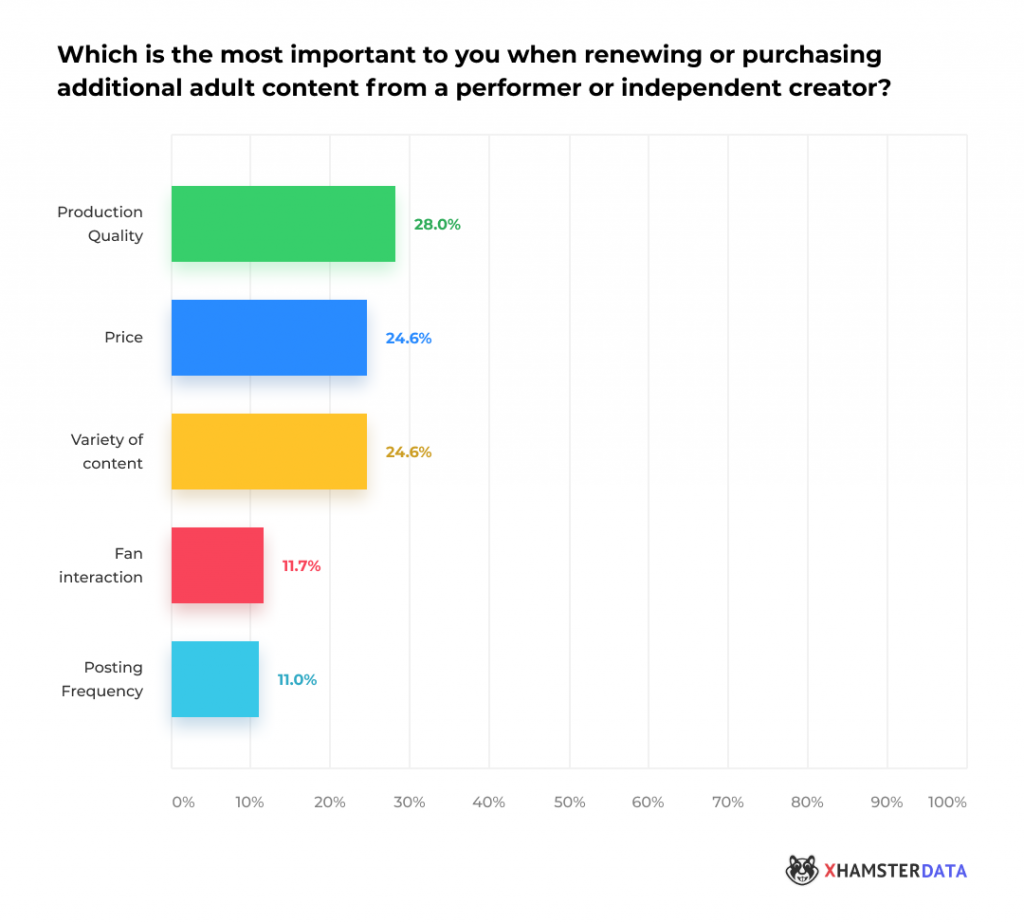

We know that so many creators feel the pressure to always be online, so we asked the question a different way. What’s most important when renewing a subscription or purchasing additional content? Once again, the frequency was the least important aspect.

Price took on more importance when people considered re-subscribing, but again it was production quality that won out. Our advice? Creators should spend more time on lighting and angles and less on getting a clip up every day a week. If it’s good, active consumers will stick around for it.

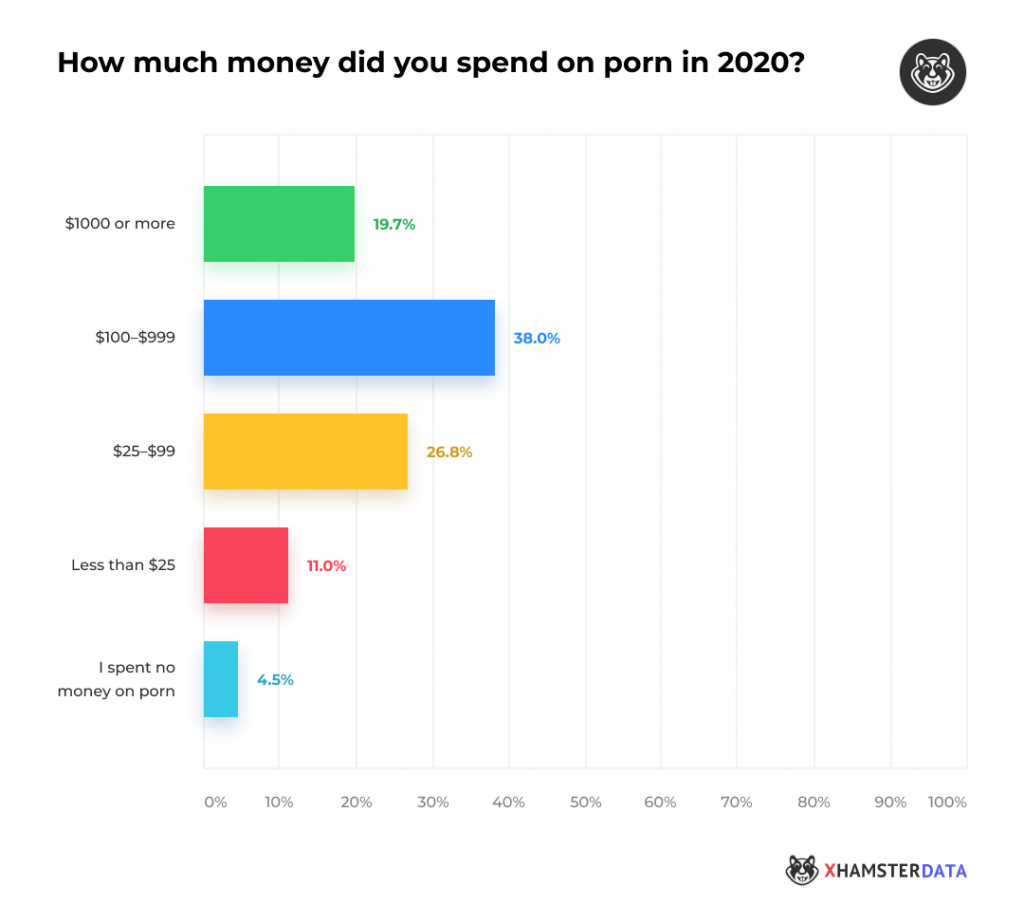

Of course, this is really just the beginning of our analysis. There’s much more data to go through. Because while active consumers are important, not every consumer is equal. Nearly 20% of the active consumers said they spent over $1000 a year on adult content. But how to find them?

We’ll get into that more in our next report.

This report is the first in a series of reports geared at independent creators. In future reports we’ll do more in-depth data analysis, to help you develop a business strategy that works for you.

Upcoming reports include Cam vs Fan Consumers, The Big Spenders, What Sells for Creators, LGBTQ Market, Sex and Politics, the German market, and others.

To sign up to become an xHamster Creator, and have these reports delivered to you directly when they publish, visit xhamster.com/creator-signup.

Have any questions? Email [email protected], and we’ll do our best to answer — backed by data!